Johannesburg, 19 March 2024 – Afrimat, the JSE-listed mid-tier mining and materials company providing construction materials, industrial minerals, bulk commodities, and future materials and metals, has released the findings of its Afrimat Construction Index (ACI) for the fourth quarter of 2023. The ACI is a composite index of the level of activity within the building and construction sectors and is compiled by economist Dr Roelof Botha on behalf of Afrimat.

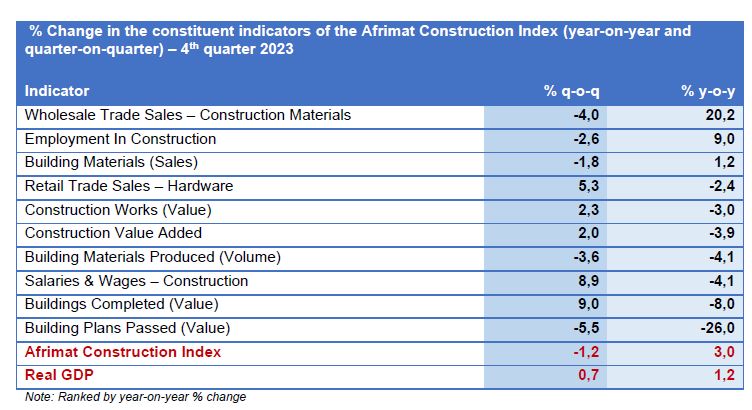

According to Dr Botha, the lethargy of the economy as a whole during the fourth quarter of last year was evident in the construction sector, with five of the 10 constituent indicators of the ACI recording quarteron-quarter negative real growth rates and the ACI dipping by 1.2% as a result. “However, viewed year-on-year, the ACI expanded and even outperformed the economy with 3% real growth rate, compared to real GDP growth of 1.2%. The year-on-year growth rate was mainly due to exceptionally strong performances by the indicators for employment and wholesale sales of construction materials.”

Botha says that the year-on-year basis expansion of the ACI is encouraging, especially against the background of the high cost of capital in South Africa, adding that it was especially encouraging that the important indicator of job creation expanded in 2023, with 110,000 new jobs having been created, compared to 31,000 in 2022.

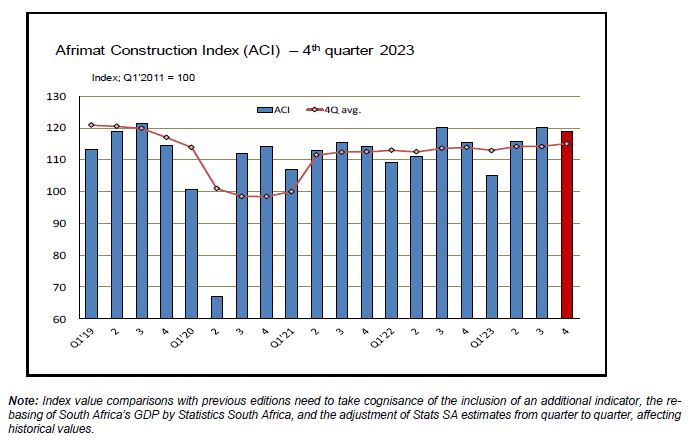

The index recorded a level of 118.9 in the fourth quarter, compared to 120.3 in the previous quarter, and 116 in the second quarter. “Significantly, the latest four-quarter average reading of the ACI – which eliminates seasonal influences – has risen further and is close to the same level as before COVID-19, which means that construction activity has more or less fully recovered from the negative impact of the lockdowns and recession that accompanied the pandemic.”

Botha points out that the index values for the fourth quarter are not strictly comparable to the previous quarter due to the broadening of the base of constituent indicators to include the real value of construction works, a component of gross fixed capital formation in the economy.

“Also encouraging is the quarter-on-quarter increase of 9% in the value of new buildings completed, albeit from a low base. It remains concerning, however, that the real value of construction works remains lower than in the fourth quarter of 2019, i.e., pre-COVID-19. This indicator is under pressure from a combination of fiscal constraints, dysfunctional municipalities, and restricti e monetary policy,” says Botha.

According to Botha, the two indicators in the ACI that continue to fare very poorly are the “Value of Building Plans Passed” and “Buildings Completed at Larger Municipalities”. He explains that these data sets are aligned with the continued decline in the number of mortgage bond applications administered by BetterBond and a hefty increase in the average deposit required for a home loan. In 2019, first-time homeowners required a deposit of around R60,000, on average, to access a mortgage loan. “This has now shot up to just below R250,000, which acts as a significant deterrent to residential property market activity.”

According to Botha, several key drivers have come to the fore that may lead to an expansion of construction activity in 2024 and beyond, including the following:

- Further progress with the switch to renewable energy, much of which is intrinsically linked to construction activity.

- Visible signs of closer cooperation between the private sector and government agencies in the maintenance, repair, and expansion of the country’s logistics infrastructure.

- The consistent decline in the CPI and PPI, which should lead to a series of interest rate declines in 2024. Several economists polled by Unisa’s Bureau for Market Research expect interest rates to decline by up to 100 basis points during 2024 and even further in 2025.

Afrimat’s EO, ndries an Heerden, said that the Group has consistently delivered good results in a challenging environment because of a strong company culture, high standard of execution, ongoing diversification to support Group moats, and continual evaluation of efficiencies across the Group.

Van Heerden adds that the Construction Materials part of the Group is experiencing an improved demand for products, although from a low base. “These products are supplied into Government infrastructure, road and rail projects,” he said. This supports what Botha references as “Visible signs of closer cooperation between the private sector and government agencies in the maintenance, repair, and expansion of the country’s logistics infrastructure.”

Afrimat’s di ersified portfolio is working to protect the Group against economic fluctuations and the structure remains strongly cash-generative – a critical position to be in given the current operating en ironment. “We eagerly await the decision from the Competition Tribunal to ratify the Competition Commission approval of the Lafarge acquisition and hope that a decision is awarded soon so that Afrimat can begin to turn the business around, primarily to protect the roughly 800 jobs and livelihoods.

“Being part of the Ore Exporters Forum, Afrimat is poised to continue supporting the public sector to ensure an efficient rail export network remains in place. We are encouraged by recent executive management appointments and can see improvement in the operations. My wish for South Africa is great private sector participation and collaboration for a much better functioning South frica for all its people,” van Heerden concludes.

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za