| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

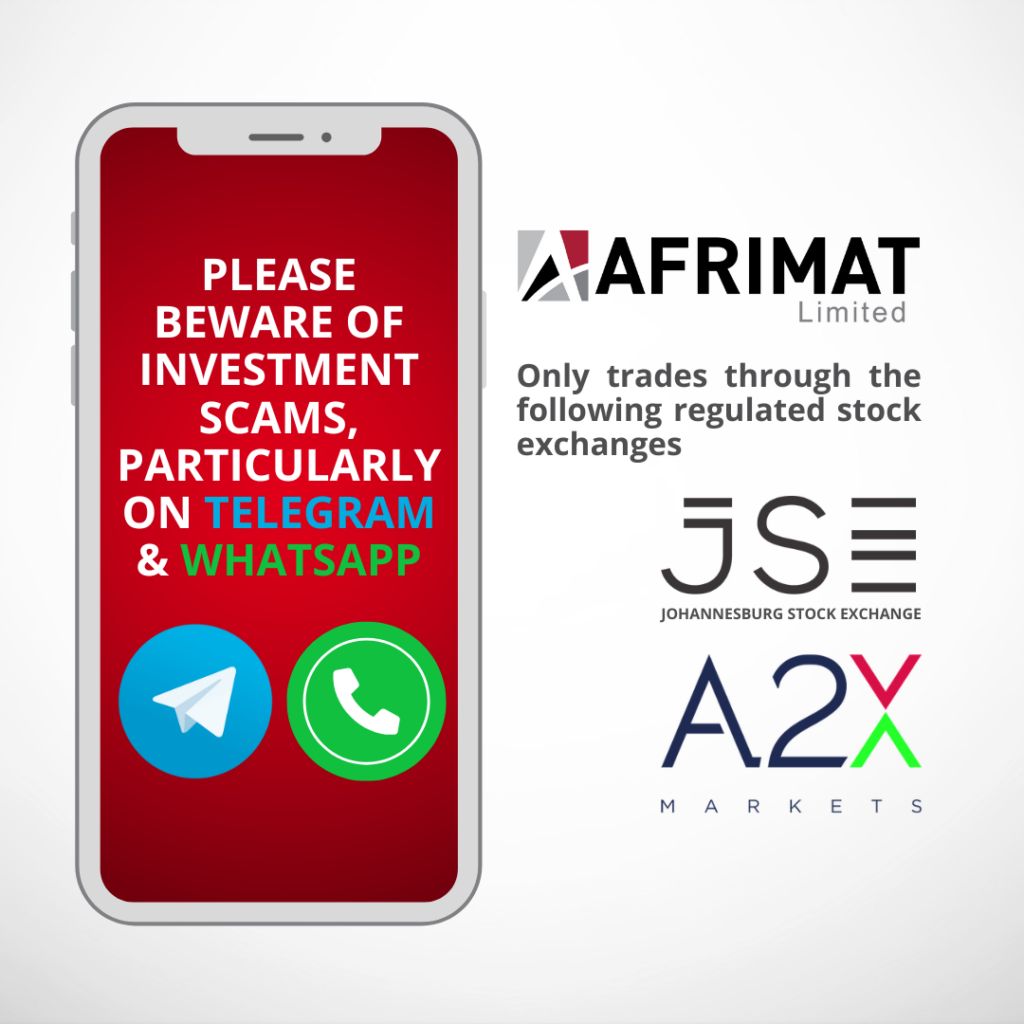

Afrimat has noted an increase in fraudulent Telegram and WhatsApp accounts, utilising Afrimat’s Corporate Identity and/or the names and photos of senior Afrimat management, offering services ranging from investment brokering to cryptocurrency trading.

Afrimat has never, and does not intend to in future, offer any financial, investment or related services through any platform.

Afrimat only trades through the regulated stock exchange of the JSE and A2X.

Any other investment scheme or financial service on any platform other than these regulated stock exchanges, are false.

Please direct any scams to our Whistle-Blowing hotline:

Afrimat: Head of Communications

Tanya.pretorius@afrimat.co.za

Keyter Rech Investor Solutions

Vrech@kris.co.za