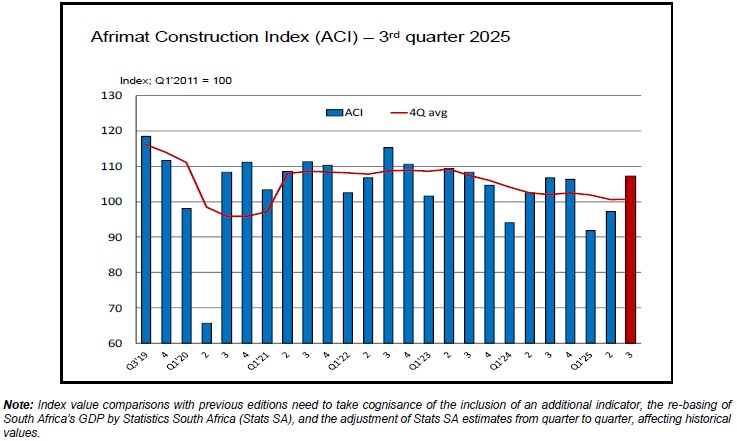

Johannesburg, 4 December 2025 – The findings of the Afrimat Construction Index (ACI) for the third quarter of 2025 have been released, with an impressive double-digit quarter-on-quarter increase, representing a significant improvement over the second quarter results. This composite index of activity levels in the building and construction sectors is compiled every quarter by economist Dr Roelof Botha on behalf of Afrimat.

According to Dr Botha, arguably the most impressive aspect of the latest ACI is that the downward trend of the four-quarter average has been arrested, with a marginal uptick recorded.

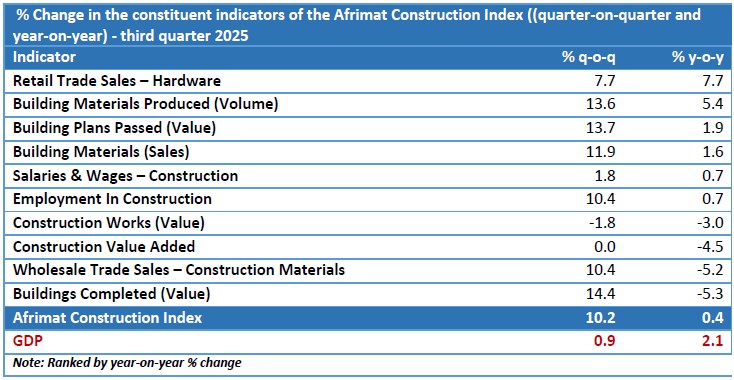

“The majority of indicators recorded double-digit growth rates, whilst the volume of building materials produced enjoyed the second highest year-on-year increase and the third highest quarter-on-quarter increase.”

He added that a further decline of 25 basis points in the prime overdraft rate during this period also played a role in the improvement of several indicators, especially in the values of building plans passed and retail trade sales of hardware.

Construction sector activity outperformed the GDP by a healthy margin during the third quarter of 2025, although it lagged behind overall economic activity compared to the third quarter of last year.

The following table shows the quarter-on-quarter and year-on-year percentage changes for the 10 constituent indicators included in the ACI.

According to Botha, it is encouraging that only one of the 10 indicators failed to record quarter-on-quarter growth, namely the value of construction works (in real terms). “The lack of progress with capital formation in the economy, which is generally associated with a significant element of construction works, should be of concern to the Government, as the country is in dire need of repairs and expansion of infrastructure, especially roads, water, and sewage.”

He added that it was, howe er, worth noting that South Africa’s economic growth prospects ha e impro ed lately, mainly due to the lower interest rates and a lar e measure of fiscal stability. “The latter has been boosted by the performance of gold and platinum prices, which played a key role in securing a healthy cumulative trade surplus during the first ten months of the year.”

Looking ahead, Dr Botha expects a further recovery in construction sector activity, especially due to the latest decrease in the prime overdraft rate to . 5%. “ Although the modest relaxation of monetary policy is to be welcomed, more interest rate cuts are required to bring the cost of capital in South Africa in line with our key trading partners.”

Afrimat’s strategic expansion and positive outlook

Andries van Heerden, the CEO of Afrimat, says that the Group’s acquisition of the Lafarge assets was a deliberate strategic move aimed at expanding its geographic footprint and securing access to well-designed, high-quality quarries. “While these assets experienced some neglect during the Competition Tribunal approval process, they are now beginning to deliver on the potential we originally identified.”

Although the Government has yet to announce major infrastructure maintenance or new development projects, Afrimat is seeing tangible benefits from provincial and private sector spending across the country.

Van Heerden added that, in the quarry business, every ton sold contributes to overall performance, and that is exactly what Afrimat is now experiencing. “Even previously closed quarries, which we have successfully reopened, are now receiving meaningful orders, and margins are stabilising. This trend aligns with recent construction sector data reflected in the and supports the recent upgrade of South Africa’s credit rating.”

He went on to say that, encouragingly, the cement plant in Lichtenburg achieved break-even in recent months and continues to improve in terms of both reliability and clinker output. “Although losses from the first half of the financial year will not be fully recovered, we do not anticipate that the losses will escalate further. Demand for cement, both bagged and bulk, remains strong in our local and regional supply regions, mirroring the robust demand for aggregates.”

What Afrimat is experiencing currently is very reassuring. “We attribute this progress to the commitment of provincial managers and leaders, as well as the private sector, who are actively working together to restore national pride and ensure that infrastructure operates effectively. We remain confident that collaboration between the public and private sectors will drive sustainable growth for all South Africans.”

Van Heerden concluded by saying that Afrimat’s positioning as a multi-commodity, diversified mid-tier mining company, producing and supplying construction materials, iron ore, anthracite, and other minerals, places it firmly on a path to support the growth South Africa is ready for.

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za