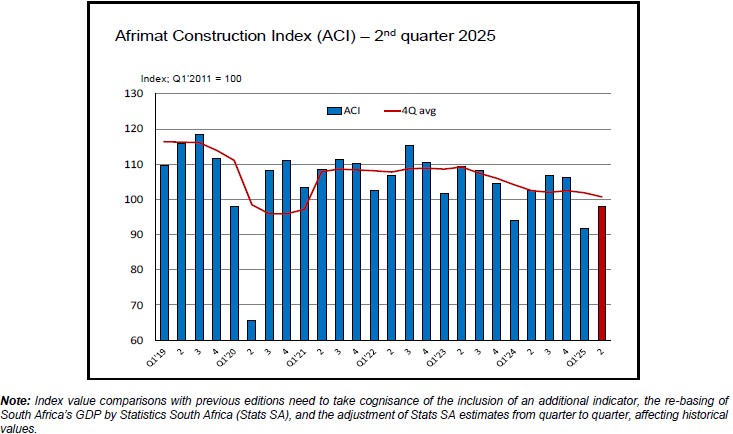

Johannesburg, 15 September 2025 – Afrimat, a multi-commodity, mid-tier mining company that produces and supplies construction materials, iron ore, anthracite, phosphate, and high-quality industrial minerals, today released the findings of its Afrimat Construction Index (ACI) for the second quarter of 2025. This is a composite index of the level of activity within the building and construction sectors compiled by economist Dr Roelof Botha on behalf of Afrimat.

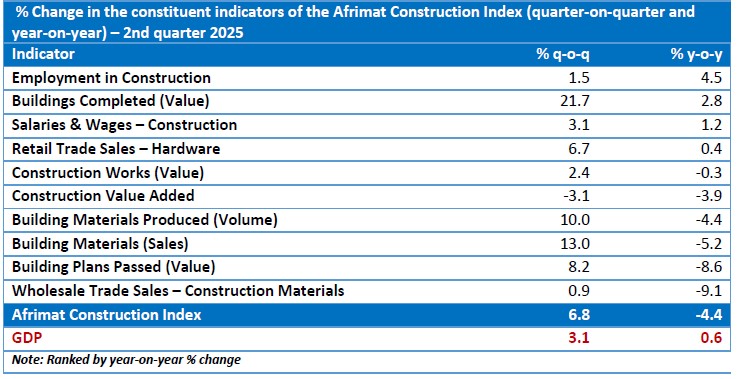

“A strong rebound occurred since the first quarter of 2025 for several key indicators, most notably the value of buildings completed, up by 21.7%, the sales value of building materials, up 13%, and the volume of building materials produced, up 10%, ” said Dr Botha.

According to him, the recovery of the ACI was, however, fairly predictable, as the indicators included in the index came off a low base recorded in the first quarter of the year. The further marginal decline in the prime overdraft rate during the second quarter also played a role in the improvement.

Despite the impressive quarter-on-quarter overall increase in the ACI of 6.8% during the second quarter, which is more than double the GDP growth rate, it remains a point of concern that the year-on-year change remained negative, said Dr Botha.

The table that follows provides the quarter-on-quarter and year-on-year percentage changes for the 10 constituent indicators included in the ACI.

Looking ahead, Dr Botha expects a further recovery in construction sector activity, especially due to the upward trend in the value of building plans passed, as well as the rise in the latest reading of the BetterBond Index of Home Loan Applications.

“The impact on the residential property market of the recent lowerin of the country’s benchm rk lendin rate has been reflected in the latter index increasing by 14% year-on-year during July and August. In the process, the number of home loan applications reached its highest level since the third quarter of 2022, when record high interest rates really started biting into the pockets of prospective homebuyers.”

Botha added that the residential property market is slowly but surely building up steam, which will ultimately benefit construction activity at large. “The pace of further recovery in the construction sector will, however, only gain significant traction once the prime rate has returned to its level of 7% that existed immediately after the pandemic, and the Government takes re l ction on it l infr structure projects.”

From a business perspective, Afrimat has not really felt the impact of what the latest year-on-year reading of the ACI indicates.

“Given the success with the turnaround of most of the ex-Lafarge businesses, together with the contribution from our mining assets, Afrimat was able to counter the lack of infrastructure spending by the Government. We are starting to see early progress, with the rebuilding of the country’s r il systems, and this, along with the expansion of the electricity distribution network, bodes well for the future of our Construction Materials business,” explained Afrimat’s CEO, Andries van Heerden.

Focusing specifically on this segment of Afrimat, van Heerden says that with the acquisition and integration of the ex-Lafarge quarries, along with investments to address neglect and the completion of integrating information systems and management structures, the second quarter of the financial year saw improved operational efficiencies and increased profitability.

This was also aided by regaining market share previously lost when Lafarge began exiting South Africa. “We got this right, through improved service delivery to customers who were previously neglected.”

Afrimat’s diversified operations, its acquisition of Lafarge South Africa, and the fact that 50% of the Transnet-approved quarries are owned by Afrimat, ensure that it is well-positioned to support Transnet’s infrastructure development and maintenance across all six major rail corridors. The Group continues to evolve its cement strategy, aligning with global sustainability trends and operational efficiency.

“We believe the traditional cement model is no longer viable in today’s market. By reducing reliance on costly and environmentally taxing components and incorporating extenders innovatively, we can supply compliant, cost-effective, and lower-carbon cement products to the market,” van Heerden said, going on to explain that demand for low-carbon cement is supported by attractive sales volumes.

He concluded by saying that Afrimat can play a key role in these strategic national projects by supplying critical construction materials and leveraging its national footprint.

-Ends-

Issued for: Afrimat Limited

- Contact: Andries van Heerden, Chief Executive Officer (CEO)

- Tel: 021-917-8853

- Email: andries@afrimat.co.za

- Website: www.afrimat.co.za

- Issued by: Keyter Rech Investor Solutions

- Contact: Vanessa Rech

- Tel: 083-307-5600

- Email: vrech@kris.co.za